CLAIRMONT CAPITAL GROUP

Property-Level GP Co-Investment

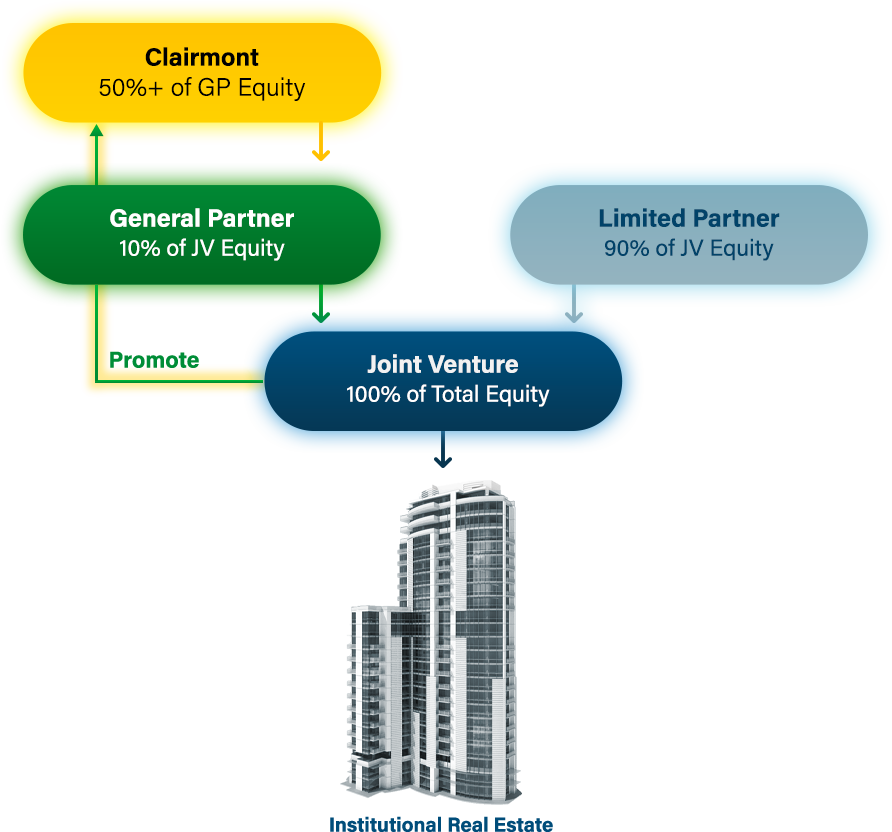

Clairmont is a pioneer in the niche asset-level GP co-investment sector, a strategy that aims to provide qualified investors an attractive opportunity to earn meaningful risk-adjusted alpha (“a”) when compared to the institutional Limited Partners (“LPs”) it invests alongside. As Clairmont’s flagship strategy, the firm has successfully managed a series of opportunistic fund vehicles and separate accounts that are exclusively focused on executing GP equity co-investments with tenured, best-in-class sponsor operating partners in cycle-resilient asset classes across the US.